MSME Listing

MSME LISTING

Making a public issue of securities and listing on stock exchanges is a dream of every entrepreneur. We groom MSME’s to get listed in stock markets.

We are SME IPO consultant and SME IPO advisors! Traditionally debt/ loans used to be an instrument available to companies to raise funds for business. However, there are certain costs such as marketing, logistics, research, a brand creation where debt option is not available.

Companies also opt for Venture Capital / Private Equity. However, performance pressure and stringent conditions make such investment unattractive for most of the businesses.

Therefore, Initial Public Offering (IPO) on Main board i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) is the ultimate solution. Now after the introduction of SME Stock Exchanges small IPOs like Rs.2 Cr are also possible. SME IPOs are quick (3 to 6 months) and comparatively cost effective than Main board IPOs. Such listing entitles Companies raised a good amount of money from the public without any repayment or commitment. Also, SME IPO does not require any permission from SEBI. Further after certain period and criteria, such Companies are allowed to migrate to Main Boards of BSE & NSE.

We provide following Services to Companies for IPO Planning

- Exploring IPO possibility and Valuation

- Capital Structuring

- Short listing of Merchant Bankers & Other Intermediaries

- Searching Suitable Key Managerial Personnel (KMP) such as Chief Executive Officer (CEO), Chief Financial Officer (CFO), Company Secretary (CS)

- Guidance on searching Independent Directors

- Designing of Corporate Governance Policies& Other Policies

- Co-ordination for Due Diligence

- Co-ordination for SEBI Approvals

- Registrar of Companies Approvals

- Peer Review Certification and Audit of Financial Statements as per SEBI Guidelines for IPO

- Restatement of Financial Statements as per SEBI Guidelines for IPO

- Certifications for IPOs

- Convergence and Implementation of IND AS for listed and under listing Companies

- Statutory Audit and other audits for listed Companies

ABOUT IPO’s

IPO Sizes

SME IPO size is Rs 1.50 Cr to 40.00 Cr in recent times. More than 200 Companies have listed on SME Exchanges. Main board IPO are usually on the higher side.

Suitable

SME IPOs listing is suitable for companies with low turnover, less capitalization but the potential for high growth in near future. Upcoming companies, startups, e-commerce, technology companies, infrastructure, developers, agro focused companies are few of them.

BENEFITS OF GETTING LISTED IN THE STOCK MARKET

- Reduction of debt burden.

- Fund-raising for Capital expenditure, expansion, new projects, M&A etc from Public.

- Raise funds for activities such as marketing, research where debt is not available.

- Liquidity to investors/share-holders without affecting the stability of the company.

- Listed companies generally find that the market perception of their financial and business strength is enhanced.

- Listing raises a company’s public profile with customers, suppliers, investors, financial institutions and the media.

- An initial listing increases a company’s ability to raise further capital through various routes like preferential issue, rights issue, Qualified Institutional Placements and ADRs / GDRs / FCCBs, and in the process attract a wide and varied body of institutional and professional investors.

- IPO listing is also a great solution for companies struggling with succession planning and that have difficulty in getting acquired by another company. IPO listing also helps Companies to convert paper currency in currency. It can help to issue ESOPs and retain talent.

TAX BENEFITS OF GETTING LISTED IN THE STOCK MARKET

The sale of unlisted shares in short-term attract the capital gain tax up to 30% as applicable to the taxpayer and the long-term capital gain tax of 10% without indexation and 20% with indexation.

The sale of listed securities in the short term attract the capital gain tax of 15% and there is no long-term capital gains tax provided it has been subject to Share Securities Transaction Tax. This makes it clear that the listing of shares is a very attractive option for SMEs.

ELIGIBILITY CRITERIA FOR LISTING ON NSE EMERGE PLATFORM

The following criteria should be complied with as on the date of filing the Public Offer Document with NSE as well as when the same is filed with RoC and SEBI.

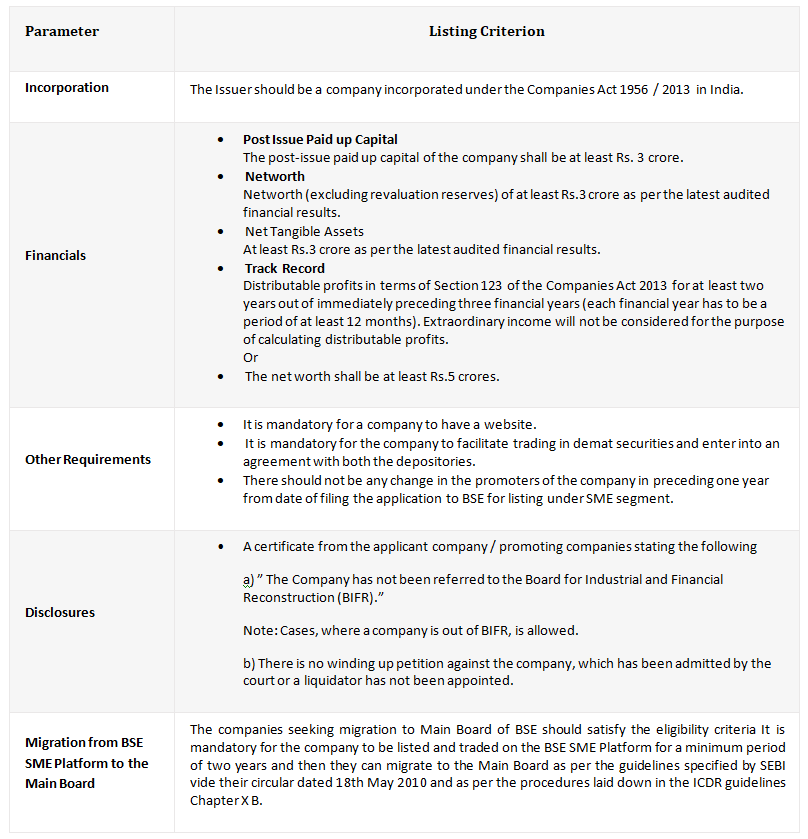

ELIGIBILITY CRITERIA FOR LISTING ON BSE SME PLATFORM

OTHER REQUIREMENTS

- It is mandatory for a company to have a website.

- It is mandatory for the company to facilitate trading in demat securities and enter into an agreement with both the depositories.

- There should not be any change in the promoters of the company in preceding one year from date of filing the application to BSE for listing under SME segment.

DISCLOSURES

a) ” The Company has not been referred to the Board for Industrial and Financial Reconstruction (BIFR).”

Note: Cases where company is out of BIFR is allowed.

b) There is no winding up petition against the company, which has been admitted by the court or a liquidator has not been appointed.

MIGRATION FROM BSE SME PLATFORM TO THE MAIN BOARD

The companies seeking migration to Main Board of BSE should satisfy the eligibility criteria It is mandatory for the company to be listed and traded on the BSE SME Platform for a minimum period of two years and then they can migrate to the Main Board as per the guidelines specified by SEBI vide their circular dated 18th May 2010 and as per the procedures laid down in the ICDR guidelines Chapter X B.

OUR CLIENT ENGAGEMENT PROCESS

Free Business Plan Consulting Session

A client can request for a free consultation session through the following options:

- An interested person could click on the following tab “Request for free Consultation” to book a free consultation session with our experts.

- A form will be generated requesting for basic contact details and a brief write up about the business.

- Fill in the details and press the send button.

- A consultant will get in touch within 24 hours via the preferred mode of engagement defined in the form, to discuss the business proposition.

- A successful request will generate the following message.

“Thank you for contacting GSPUSTARTUP We have received your request. One of our consultants with contact you shortly.

For further queries please feel free to write to us at info@gspustartup.com

Send an email to info@gspustartup.com requesting for an appointment. The email will need to contain the following:

- A brief write up of the business

- Two suitable time slots for the session

- Telephone number

(please mention preferred mode of contact)

A confirmation email containing details about the time and mode of engagement will be sent within 24 hours.

A client can call GSPU Consulting in India in the board line number: +91 8590510888 where consultant’s will be available to discuss the business proposition. In the event that consultants are busy and fail to respond immediately, leave a voice message with;

- Two suitable time slots

- Telephone number and email ID (please mention preferred mode of contact)

A consultant will be in contact through the suggested mode of communication. Please note that the suggested time slots should have a gap of at least 24 hours, after the telephone call is made. This session will provide an opportunity for clients to engage with a consultant and discuss all aspects of the business. The consultant will be happy to respond to queries and suggest an appropriate business plan package. However, prospective client’s will have to decide on the package that fit’s their need.

If satisfied with the free consulting session and ready to place an order, follow the “Select Package” process as defined below.

Select Package

A client can directly select a package from the website, read and agree to the terms and conditions, before place an order for a business plan. The process to be followed is described below;

- Click on the “Order Now” tab placed at the end of package features chart or on Package details page.

- Fill out the personal information section.

- Read and agree to our terms and conditions.

- A requirements analysis form will be generated. Fill all sections of the form.

- On completion, the details of the form will be sent to info@gspustartup.com, by pressing the submit tab.

- A successful request will generate the following message.

“Thank you for contacting info@gspustartup.com. We have received your request. One of our consultants with contact you shortly. For further queries please feel free to write to us at info@gspustartup.com.

or call us at our India board line number +91 8590510888

RESEARCH REPORT

The first deliverable will be in the form of a market research report. A draft version will be sent for feedback. The consultant should be informed of all changes needed. Changes will be discussed and incorporated into the document by the consultant. On completion, an amended version of the research report will be resent to the client.

Once all changes have been incorporated, an invoice will be sent through e-mail, for milestone completion payment. The invoice will be equal to 25% of the total project value. (Release of payment in the absence of any other written confirmation will be considered as acceptance of quality for each milestone).

All documentation will be sent via e-mail, in a secure non printable pdf format. The editable version of the complete business plan will be sent at the end of the project. All feedback and amendment requirements will have to be sent back to the consultant via the same e-mail ID.

REQUIREMENTS ANALYSIS

This is the first phase of the business planning process. On receiving the order, the consultcalive team will check the details submitted for accuracy and completeness. In the event that discrepancies are found, the client will be informed through the e-mail address provided. Should all the details be in order, the team will analyze and allocate resources for the project and consultcalive will send an e-mail with details about the team/consultant assigned for the project.

The e-mail will also contain an invoice equalling 50% of the total package cost. This amount will have to be paid by the client as part of the requirements analysis milestone. The assigned team/consultant will commence working on the project once the first milestone has been funded.

STRATEGIC PLANNING

This section is the heart of the business plan. The engagement and acceptance model will be similar to the research report segment, where the consultant will send a draft version of the document for feedback and suggested amendments. The changes will be discussed, incorporated and sent back for further feedback. Once the section is approved, an invoice will be sent via e-mail. The invoice value will be equal to 25% of the total value.

All documentation will be sent via e-mail, in a secure non printable pdf format. The editable version of the complete business plan will be sent at the end of the project. All feedback and amendment requirements will have to be sent back to the consultant via the same e-mail ID.

FINANCIAL CALCULATIONS

This is the final segment of the business plan. The consultant will engage and send a document to capture costs and revenue numbers to the client. The consultant will analyze the numbers, create financials and present them in the form of tables and graphs. The draft financials will be sent for feedback and suggested amendments. Changes and amendments will be incorporated.