STARTUP FUNDING

GSPU STARTUP support entrepreneurs, early stage startups and small businesses through the fund seeking process with the help of our consulting support and guidance.

We advise businesses across all stages on how to go about their funding requirements. We provide end-to-end guidance throughout the fund seeking process, right from approaching investors to the final contract phase.

Funding is the key for starting a business. There are various ways a business can raise the required start-up capital. The most important ingredient to your capital search is a good business plan that shows investors the venture’s potential. Having a great business plan doesn’t guarantee funding but definitely increases the chances of getting funded.

We at GSPU STARTUP have a comprehensive consulting approach that helps businesses to structure their fund seeking process. With streamlined activities and a phased approach it becomes easier for businesses and entrepreneurs to effectively organize their funding search.

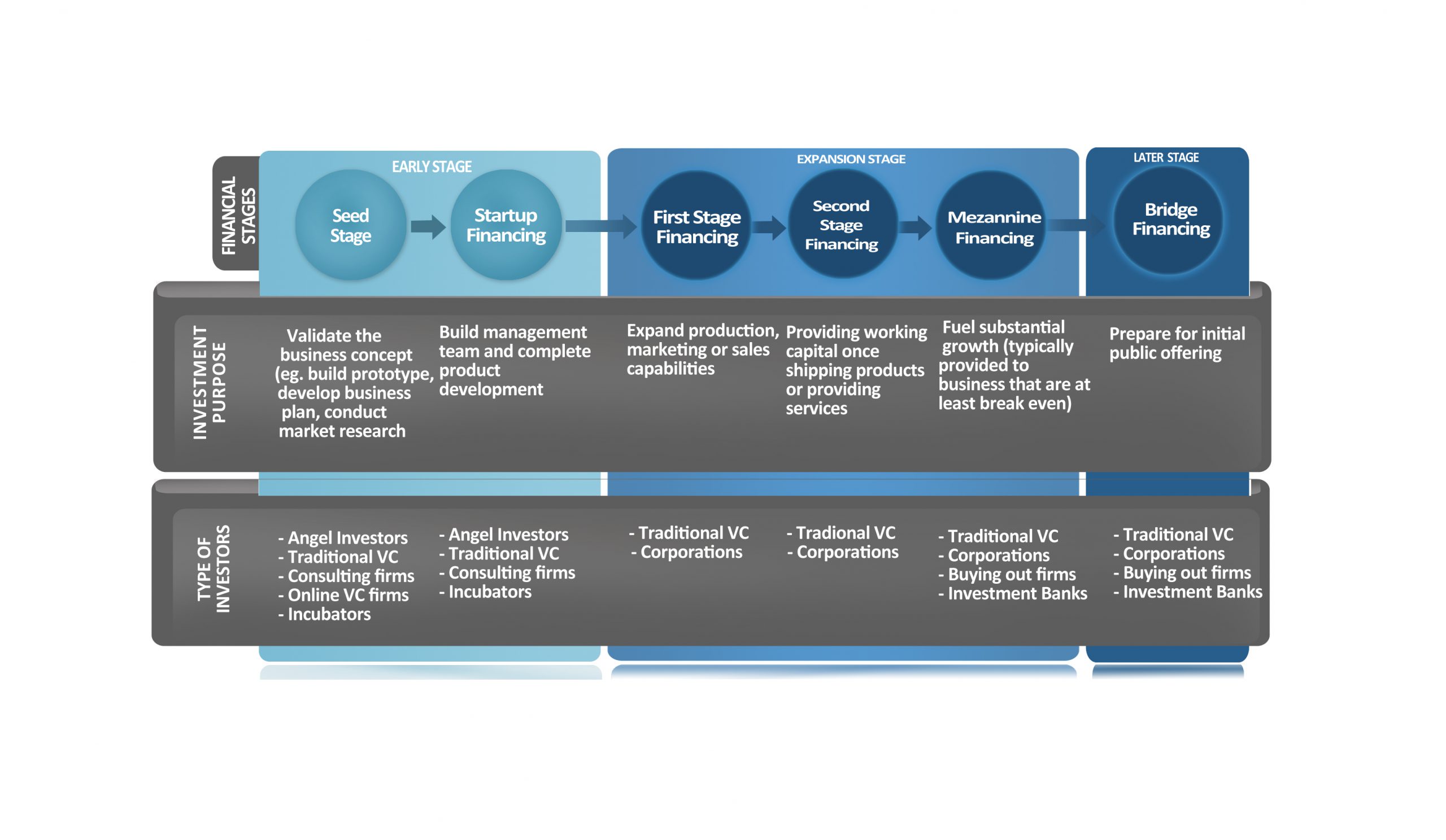

We help businesses at all stages through our funding assistance services. Each stage has its inherent challenges. We help business owners by educating, mentoring and guiding them through the customized process for respective stage. The funding stages are explained below.

STAGES OF FUNDING

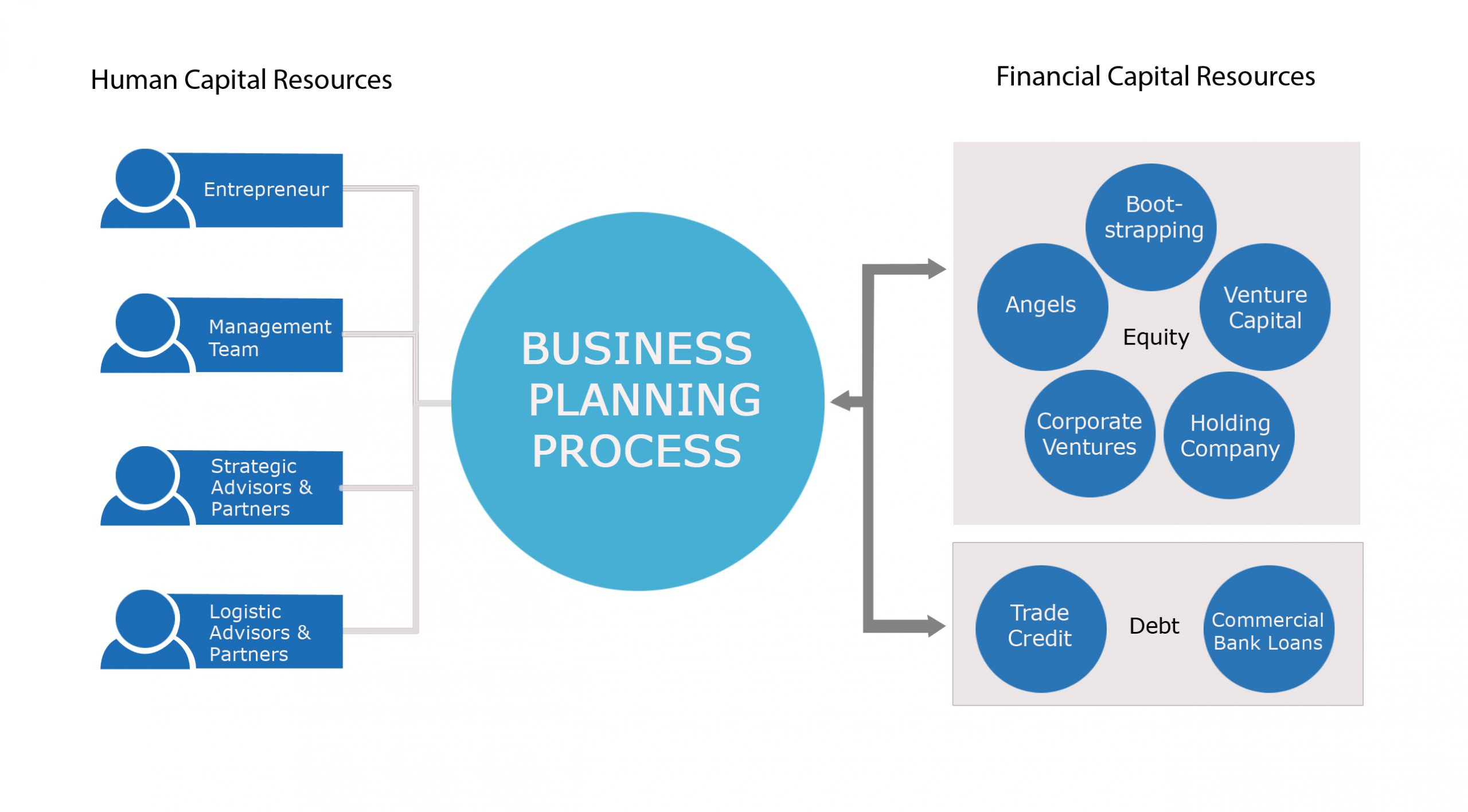

FUNDING SOLUTIONS

We help businesses to prepare and approach various kinds of investors.

Some of the popular sources of funding are:

Venture Capital (VC) provides startup capital to companies with high potential of growth. The venture capital fund takes equity in the ventures it invests in against of the capital provided. Venture Capital finances several stages of business, primarily the seed stage and early stage startups. GSPU STARTUP helps businesses to understand the process of approaching Venture Capitals and also guides them through the process.

Angel Investors are usually comprised of high net worth individual or a group of individuals who provide capital for a business start-up, usually in exchange for convertible debt or equity. Often angel investors organize themselves into angel groups or angel networks to collectively invest in ventures. GSPU provide comprehensive guidance though the process.

Private Equity investments are ideally made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investors has its own set of goals, preferences and investment strategies that include providing working capital to a target company to nurture expansion, new product development, or restructuring of the company’s operations, management, or ownership. Private Equity Firms (PE) usually invest in the expansion stage of a business.

Bootstrapping usually involves starting a business without external help or capital. Such startups fund the development of their company through internal cash flow and are cautious with their expenses. Generally at the start of a venture, a small amount of money will be set aside for the bootstrapping process.

The initial capital is raised from owner’s funds or raising from friends or family. The working of such a venture is usually on a shoe string budget and involves a different perspective of running such ventures in the initial stages. GSPU help entrepreneurs to streamline their operations to ensure the setup and functioning of the venture can be achieved within the budgeted funds.

Banks and financial institutions provide loans for businesses to setup and grow their business. The loans can be secured or unsecured in nature. Most loans are given against a collateral and / or a guarantee. This kind of funding is suitable for specific cases such as manufacturing, land based businesses, fixed capital intensive businesses but for cases where research and development or technology based intellectual property is involved loans becomes difficult to get. GSPU helps businesses through the documentation process to apply for loans.

Some government and private financial institutions across the globe have specialized loan instruments for entrepreneurs and small business owners. These loans are specifically targeted for the purpose of starting up a business. GSPU Experts help businesses with the information about such options and guide them through the documentation process to apply for loans.

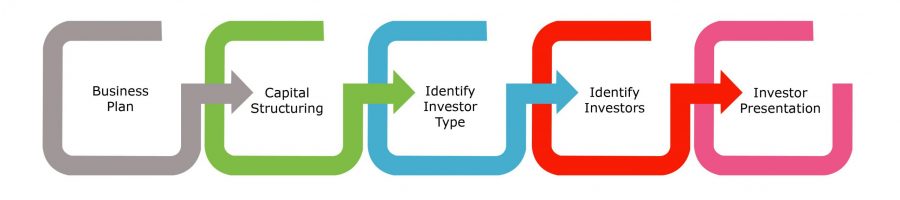

PROCESS OF FUNDING

GSPU helps businesses throughout the funding process. The process followed by GSPU is seamless and transparent. With its end-to-end offering GSPU help businesses to optimize their fund seeking activity. The foremost activity for any fund seeking process starts with the preparation of a comprehensive business plan. Once the business plan is ready and the investment requirement is identified, the team of experts at GSPU analyze the business and the funding requirements. Based on the funding feasibility and availability we help businesses to choose the right combination of debt and equity capital required. We also help in identifying the phases of funding required. Depending on the capital structure chosen the team identifies the right kind of investors best suited to fund your venture. Our team also helps in making investor presentation, representing your venture as consultant and advisors, and negotiate on your behalf.

Please note: GSPU does not guarantee funding at any point of time. GSPU is not an authorized fund raising organization. We help businesses through our consulting and advisory services only.

INVESTOR ENGAGEMENT

Investors mainly look for clear answers to the following before venturing into any investment decision. We at GSPU help our clients to be fully prepared before pitching themselves before investors.

-

Objective and Problem Solving:

The offering of any startup should be differentiated to solve a unique customer problem or to meet specific customer needs. Ideas or products that are patented show high growth potential for investors.

-

Market Landscape:

Market size, obtainable market-share, product adoption rate, historical and forecasted market growth rates, macroeconomic drivers for the market your plans to target.

-

Scalability and Sustainability:

Startups should showcase the potential to scale in the near future, along with a sustainable and stable business plan. They should also consider barriers to entry, imitation costs, growth rate and expansion plans.

-

Customers & Suppliers:

Clear identification of your buyers and suppliers. Consider customer relationships, stickiness to your product, vendor terms as well as existing vendors.

-

Competitive Analysis

A true picture of competition and other players in the market working on similar things should be highlighted. There can never be an apple to apple comparison, but highlighting the service or product offerings of similar players in the industry is important. Consider the number of players in a market, the market share, obtainable share in the near future, product mapping to highlight similarities as well as differences between different competitor offerings.

-

Sales and Marketing

No matter how good your product or service maybe, if it does not find any end use, it is no good. Consider things like sales forecast, targeted audiences, product mix, conversion and retention ratio, etc.

-

Financial Assessment

A detailed financial business model that showcases cash inflows over the years, investments required, key milestones, break-even points and growth rates. Assumptions used at this stage should be reasonable and clearly mentioned. See sample valuation template here (to be sourced under templates section)

-

Exit Avenues

A startup showcasing potential future acquirers or alliance partners becomes a valuable decision parameter for the investor. Initial public offerings, acquisitions, subsequent rounds of funding are all examples of exit options.

-

Management and Team

The passion, experience and skills of the founders as well as the management team to drive the company forward are equally crucial in addition to the all the factors mentioned above.